child tax credit september payments

That drops to 3000 for each child ages six through 17. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday.

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

The third advance monthly check comes Sept.

. Whether or not another IRS glitch is at fault for the. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. November 12 2021 1026 AM CBS Colorado.

Many parents have been spending the money as soon as they get it on things like rent and uniforms and. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August Child Tax Credit money. Katrina Smith 39 had no problems receiving the July and August payments of 750 which covered her three eligible children at 250 for each child.

The IRS sent out the third child tax credit payments on Wednesday Sept. The credit amount was increased for 2021. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

Many parents continued to post their frustrations online Friday about not receiving their September. To be eligible for. Child tax credit Pension credit It advises that claimants will need to be in receipt of one of these benefits or have begun a successful claim as of Wednesday 25 May.

The IRS sent out the third child tax credit payments on Wednesday Sept. Including the last half of the tax credit recipients could get a total of up to 3600 per child 5 years old and younger and 3000 for every child between 6 to 17 years old. So parents of a child under six receive 300 per.

How much should your family get. September 17 2021. Simple or complex always free.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC.

That glitch affected about. Half of the total is being paid as six monthly. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat.

Tax year 2021filing season 2022 child tax credit questions and answers topics. But she said she has not gotten. That drops to 3000 for each child ages six through 17.

September child tax credit payment. In the meantime the. Learn More At AARP.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. File a federal return to claim your child tax credit. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep.

Chris Walker 37 a journalist in. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6.

Use CNETs calculator to make sure your household is getting. John Belfiore a father of two has not yet received. Users will need a copy of their 2020 tax return or barring that.

The IRS is paying 3600 total per child to parents of children up to five years of age. After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

The payments could each be up to 300 per child under. The third payment went out on September 17 We apologize The IRS said. We are aware of.

The next child tax credit payment is only one week away and after that only two more checks will be sent this year for November and December. Congress fails to renew the advance Child.

Internal Audit Now Required For Itc Credit Penalties And More Internal Audit Data Analytics Tax Credits

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Adoption Tax Questions Tax Questions Family Money Cpa

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Pay Tds On Time Or Else Face Imprisonment Tax Deductions Budgeting Paying Taxes

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Interest On Delayed Gst Payments To Be Charged On Net Tax Liability From 1st September 2020 Delayed Payment Indirect Tax

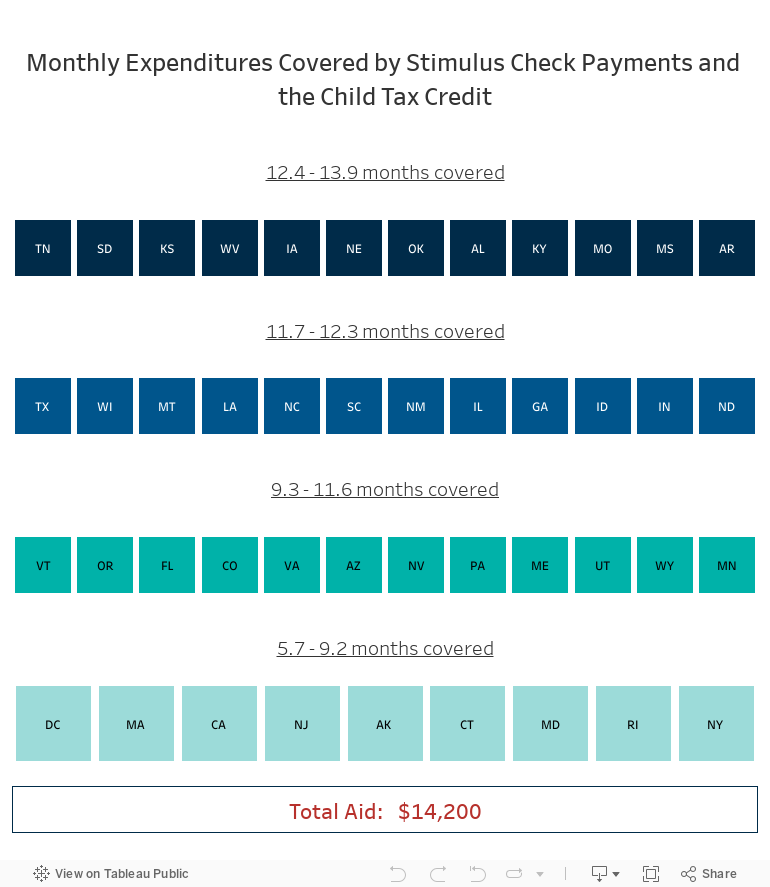

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Audit The Rich Make Them Pay Their Taxes Murderedbyaoc Audit Tax Income Tax

We Advise Taxpayers On Tax Efficient Structuring Of Cross Border Investments Including Optimum Use Of Tax Treaties Foreign Tax Investing Tax Credits Secrecy

Benefits Of Bookkeeping Bookkeeping Accounting Fiscal Year

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Will There Be Another Check In April 2022 Marca

Advance Child Tax Credit Payments Are Done But You Might Still Be Owed More Here S How To Find Out

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet